History and Development of Japan Rail Freight Transport Market

Japan’s railway system has developed significantly since the nation began modernizing in the late 19th century. The first freight lines opened in the 1870s to ship goods to and from major ports and industrial areas. Over the next several decades, Japan expanded its rail network across Honshu and other main islands under both private and nationalized systems. By the post-World War II period, seven major passenger rail operators and numerous freight-only lines served every region of the country.

The latter half of the 20th century brought enormous economic growth and industrialization to Japan. This drove huge increases in domestic and international freight volumes that pushed existing rail systems to capacity. In 1987, the Japan Freight Railway Company (JR Freight) was formed by hiving off the freight operations of the Japan National Railways, which had been privatized. JR Freight took control of freight-dedicated lines, terminals and rolling stock nationwide. It has since been the primary operator of Rail Freight Transport in Japan.

Network and Infrastructure of Japan Rail Freight Transport Market

Today, JR Freight runs on over 8,600 km of dedicated freight lines radiating out from major ports and cities. Its network connects all regions of Honshu as well as parts of Hokkaido, Shikoku and Kyushu. Most of the freight-only infrastructure lies in parallel to passenger rail corridors, though dedicated routes also run through mountainous or sparsely populated areas unable to sustain passenger trains.

JR Freight’s lines are built to high standards with few gradients able to accommodate large container block trains. Tracks are primarily electrified at 20 kV AC overhead, but some diesel operations remain. Over 230 freight terminals provide connections to marine ports, inland container depots, factories and warehouses nationwide. Advanced IT systems allow for centralized traffic control, train scheduling and real-time logistics coordination across the extensive network.

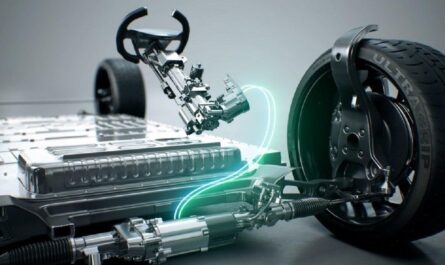

Rolling Stock and Operations

More than 6,800 wagons and 1,100 locomotives comprise JR Freight’s diverse fleet. Specialized open wagons transport bulk commodities while double-stack well cars carry thousands of containers per train. Refrigerated cars ship perishable goods. To maximize efficiency, block train operations with over 1,000 containers per train are common between major terminals.

Freight trains run 24/7 on fixed schedules coordinated with ship, truck and warehouse timetables. JR Freight aims to keep cars and containers moving all day with high productive use of tracks and facilities. Advanced trip optimization software helps route trains along the most direct or uncongested paths. Average speeds of 50-60 kph mean rail can outcompete trucks for longer distances. Integrated digital tracking allows customers to monitor shipments in real time.

Markets and Commodities

International containerized cargo makes up the largest portion of JR Freight’s business at around 40% annually. Major east coast ports like Tokyo, Yokohama and Nagoya handle massive container traffic from China, other Asian markets and the Americas. Dedicated “ChinaExpress” block trains connect Tokyo directly to Chinese coastal depots. International shipments access all regions of Honshu through extensive terminal networks.

Domestic freight encompasses a wide variety of bulk commodities and manufactured goods. Major markets include automotive, machinery, raw materials, energy products and construction materials. Coal, iron ore and containerized goods from Hokkaido’s resource industries are major northbound flows. Agriculture produces like fruits, vegetables and fish are time-sensitive southbound shipments. Liquid and gas terminals around oil refining and LNG import facilities are also strategic infrastructure nodes.

Sustainability and the Future

Environmental performance is an increasing focus for JR Freight as it is for Japan’s broader transportation sector. Shifting more cargo from trucks to rail cutting GHG emissions per ton-kilometer transported. Electrification and eco-friendly locomotives reduce local air pollution. Initiatives promote energy efficiency in terminals and optimize routing. Load optimization strategies aim to raise average wagon utilization rates.

In Summary, Japan’s National Transport Strategy aims to further develop intermodal networks integrating modern rail, marine and road assets. JR Freight expects sustainable growth serving expanding international trade corridors to China and Southeast Asia. Automated terminals may bolster efficiency while advanced equipment upgrades boost average speeds. Deeper industry collaboration on logistics coordination could maximize rail’s competitive edge versus maritime or trucking rivals. With ongoing network expansion and innovation, Japan’s rail freight sector remains well-positioned for the future.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it